Our previous posts shared information about the stimulus timeline and how to calculate the amount you can expect to receive based on your Adjusted Gross Income (AGI). This has led to people wondering…Where can I find my AGI?

The answer is simple. Your AGI is on your tax return, and here is how to find it:

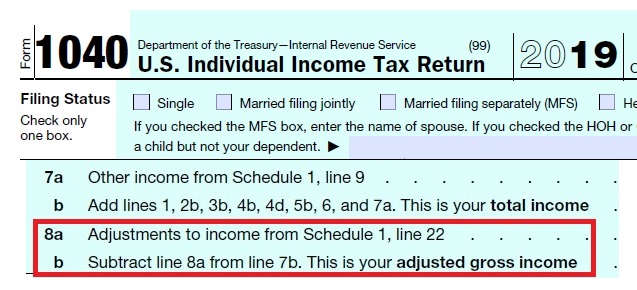

- If you have filed for this year, the IRS will use the number found on Line 8b of your 2019 return, as shown below.

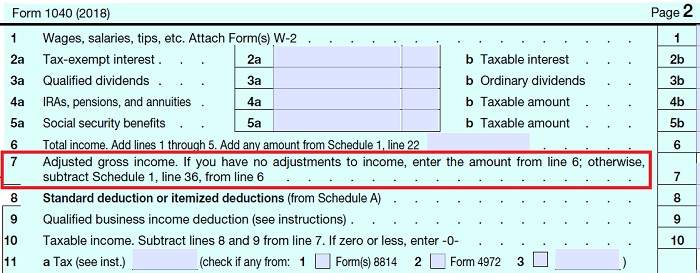

- If you have not yet filed this year, IRS will use the AGI found on Line 7 of your 2018 return.

Once you know your AGI, you can visit the IRS site to check the status and calculate your expected payment.

Important Notes:

- If you did not file taxes for 2018 and 2019, you can enter your information through the IRS online tool found at this link. Non-Filers: Enter Your Payment Info

- If you receive Social Security or Veteran’s benefits, you should automatically receive your stimulus payment.