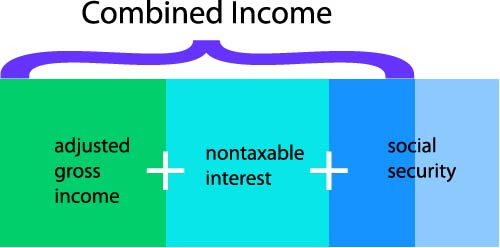

According to the IRS, the formula to determine if you will pay taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

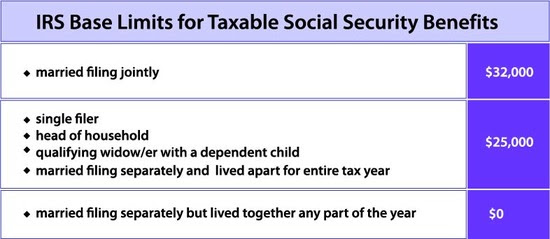

If your combined income is above a certain limit (the IRS calls this limit the base amount), you will need to pay at least some tax. The limit is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The same applies if you are married filing separately and you lived apart from your spouse for the entire tax year. The limit for joint filers is $32,000. If you are married filing jointly and you lived with your spouse for any part of the tax year, all of your Social Security income is taxable.

When retirees need extra money their first choice is generally taking an additional IRA distribution. What they may not realize is that this is taxable income, and therefore it increases their taxable Social Security amount. For example, an additional $12,000 IRA distribution may increase the taxable Social Security portion by as much as $6,000.

If it’s available to you, the safest bet for an immediate cash need is to use your savings. Though this may seem counterintuitive, you can see how adding any money that is considered taxable income to your base limit could potentially end up costing you money.

For the same reason, if you do need to take an additional distribution from your IRA, make sure you think about how much you really need. For instance, if you only need $5,000, but take $10,000 with the idea that it will give you a rainy day fund, at least some of that money may be eaten up in taxes if it causes your taxable income to exceed the base limit.

Whatever your circumstance, we are here to help. Give us a call if you have questions about the best course of action for your particular situation.